Q

Qwerty

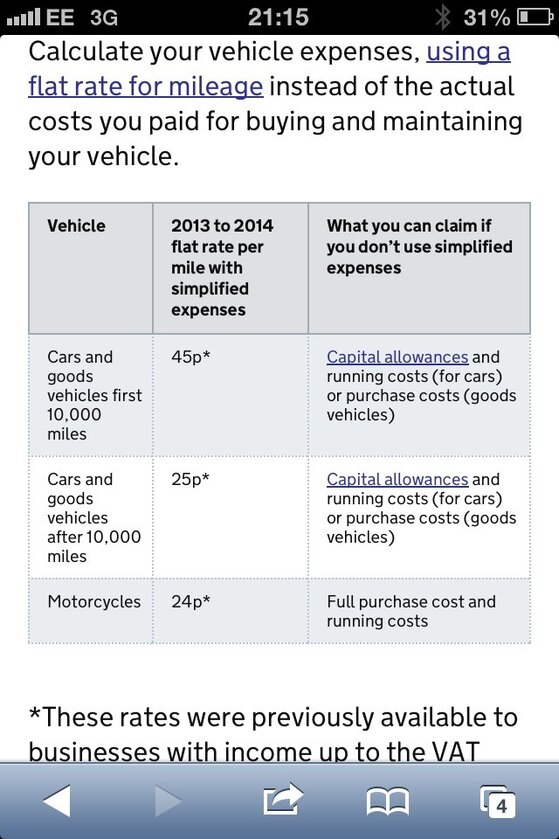

Just wondering which we all prefer to claim for when it comes to tax return time....... a proportion of the vehicle costs or mileage?

I have always been mileage, but beginning to wonder if claiming for vehicle running costs may be better?

I have always been mileage, but beginning to wonder if claiming for vehicle running costs may be better?